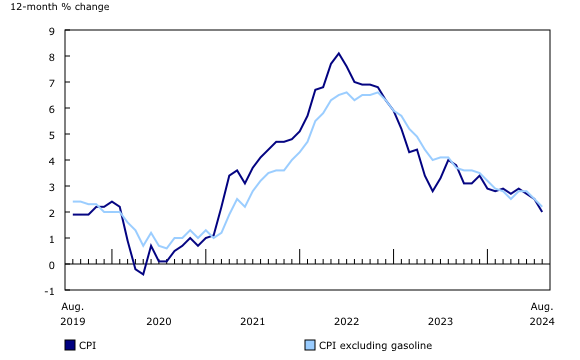

After months of navigating economic turbulence, the Bank of Canada has finally hit its inflation target of 2%. While this is a significant victory, Bank of Canada Governor Tiff Macklem has made it clear that there’s more work to be done to ensure the Canadian economy remains steady.

Speaking at an event in Toronto hosted by the Institute of International Finance and the Canadian Bankers Association, Macklem emphasized the need for the central bank to “stick the landing” and keep inflation within its target range. This is no small task—although inflation has cooled, maintaining stability in the 1-3% inflation-control band is the next challenge for the central bank.

Macklem’s Cautious Optimism on Future Rate Cuts

With inflation under control for the first time in years, many are wondering if significant interest rate cuts are on the horizon. Macklem addressed this possibility, acknowledging that it’s reasonable to expect more rate reductions, but he also noted that the pace and timing of any cuts would depend on further analysis of economic data. Essentially, while cuts are coming, the Bank of Canada isn’t ready to rush into drastic measures just yet.

The central bank has already made three consecutive rate cuts over the past few months, bringing its key interest rate down to 4.25%. As of now, the next interest rate decision is set for October, when more economic data will shed light on whether bigger cuts are needed to stimulate the economy.

Canada’s Inflation Falls to Historic Lows

In August, Statistics Canada reported that inflation had dropped to 2%, the lowest it has been in over three years. This marks a major milestone, especially after the rapid spike in inflation that began in 2022. Back in April 2022, the Bank of Canada started raising rates in a bid to cool runaway inflation, which at one point had Canadians facing skyrocketing prices across the board.

In June, the central bank made its first rate cut in more than three years as inflationary pressures finally began to ease. But even with the progress made, Macklem is signaling caution, as there’s still work to be done. According to the governor, measures of core inflation and housing prices need to show more significant declines before the Bank of Canada can rest easy.

More Rate Cuts on the Horizon?

The possibility of larger interest rate cuts is now a hot topic among economists. With inflation back under control, financial experts are beginning to predict that the Bank of Canada might opt for more aggressive rate reductions to keep the economy on track.

For instance, economists at CIBC are forecasting that the central bank could slash its policy rate by another two percentage points by mid-2025. That would require two cuts of 0.5 percentage points each—a bold move that could further boost economic activity. As it stands, the Bank of Canada’s next interest rate announcement is scheduled for October 23rd, and all eyes are on what happens next.

Digital Currency Delayed—For Now

Interestingly, Macklem also touched on another topic during his speech: the future of a central bank digital currency (CBDC) for Canada. For now, it seems that the Bank of Canada is putting the brakes on the project, with Macklem stating that there’s no “compelling case” for a CBDC at the moment.

Although digital currencies are gaining traction globally, it appears that Canada will hold off on launching its own for the foreseeable future, focusing instead on maintaining economic stability through traditional monetary policies.

What’s Next for Canadian Businesses?

With inflation back to 2% and the possibility of further rate cuts on the horizon, Canadian businesses are looking at a more stable economic future. However, the Bank of Canada’s cautious approach suggests that there’s still some uncertainty ahead. While the battle against inflation may be largely won, keeping the economy balanced will require vigilance, adaptability, and possibly more aggressive monetary measures.

For business owners and investors, the message is clear: while relief is in sight, it’s crucial to stay informed and prepared for potential fluctuations in interest rates and other economic factors.