Vancouver based quantum computing company Photonic says it has raised C$180 million in the first close of a new financing round, bringing total capital raised to C$375 million to date and adding new Canadian heavyweight backers in Royal Bank of Canada and TELUS.

The round was led by Planet First Partners, a climate focused investment firm based in London, UK. Photonic said existing investors including BCI and Microsoft also participated, and Evercore is acting as the sole placement agent on the raise.

Photonic positions the new capital as fuel for a faster path toward commercializing fault tolerant quantum computing and networking, with plans to advance product milestones, expand both technical and business teams, and deepen customer and partner engagement.

In an interview with BetaKit, Photonic CEO Paul Terry said the company expects to raise more in the coming months as it moves from deep tech development into a more explicitly commercial phase, with an emphasis on delivering quantum computing services to enterprises at scale. Terry also described the first close as a major step toward cash flow positivity and said the company aims to add dozens of staff, largely tied to commercialization. BetaKit

Why this round matters for Canada’s business economy, not just the lab

Quantum computing stories often land as abstract science news. This one has a more practical Canadian business angle because the investor list includes a major bank and a national telecom, two sectors with immediate incentives around security, infrastructure, and competitive advantage.

In Photonic’s announcement, RBC framed the investment as its first direct equity bet in a quantum computing company, pointing to potential financial sector applications such as security, portfolio optimization and risk modelling. TELUS Global Ventures linked its investment to a view that quantum could reshape secure telecommunications infrastructure, and positioned Photonic as aligned with data centre scale, distributed services.

For Canadian entrepreneurs, the signal is less about buying a quantum computer and more about the shape of the market that is being built around it. Photonic and its investors are describing a model closer to cloud, where businesses eventually buy access to capability, not hardware. That matters because it lowers the barrier for mid sized firms to experiment with advanced compute without becoming a research lab.

What Photonic is building, in plain language

Photonic’s pitch is that the biggest challenge in quantum is scale, getting enough reliable qubits working together long enough to do useful work. The company says its approach, branded Entanglement First, combines silicon based qubits with photonic connectivity so systems can scale across existing telecommunications style infrastructure.

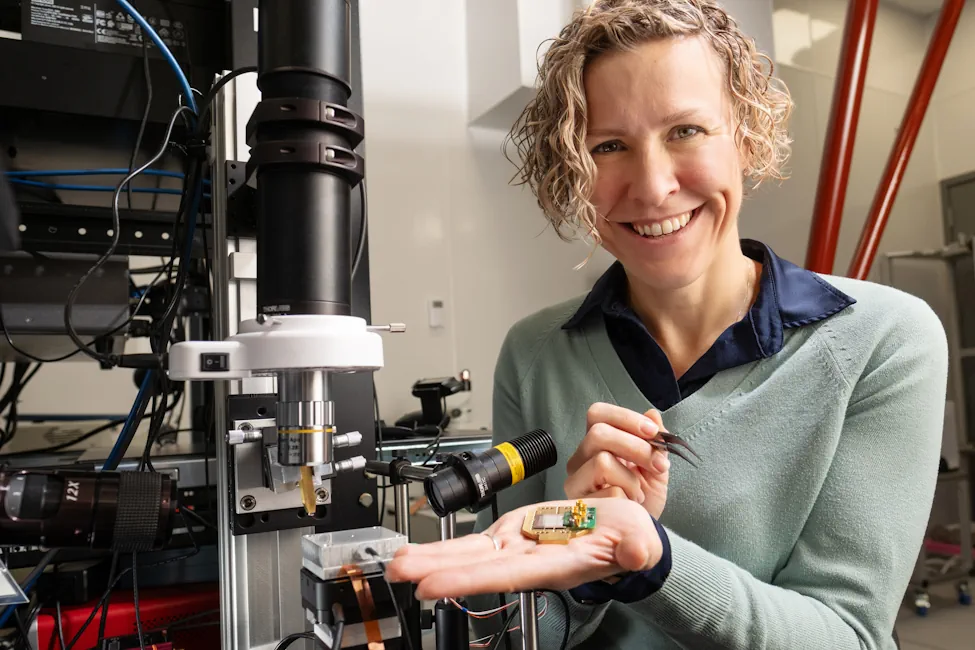

BetaKit’s reporting adds an important detail about how Photonic explains this strategy. Photonic co founder and chief quantum officer Stephanie Simmons describes entanglement as the property that links particles even at a distance, and the company’s thesis is that networking quantum systems through entanglement is a credible route to utility scale performance. Simmons also pointed to potential use cases tied to network security, such as detecting eavesdropping or unauthorized listening, which helps explain why a telecom investor would care early.

Photonic’s own materials describe the company as headquartered in Vancouver with operations in the US and UK, and a team in the 150 plus range.

A funding environment that has been uneven for quantum

The size of this round stands out because quantum funding has not been uniformly easy. BetaKit notes that other quantum companies have faced fundraising pressure and points to different financing paths in the sector, including going public through alternative structures rather than relying strictly on private venture rounds.

That context matters for Canadian founders watching deep tech. The takeaway is not that quantum is suddenly “solved,” but that investors appear willing to fund platforms that can show a believable route to commercialization and a market model that reaches beyond a handful of elite buyers.

The federal policy backdrop: Ottawa is trying to anchor quantum IP in Canada

Photonic’s financing comes shortly after the company announced it was selected for Phase 1 of the Canadian Quantum Champions Program, which it said provides up to $23 million in funding. The program, described as led by Innovation, Science and Economic Development Canada with technical due diligence by the National Research Council of Canada, is explicitly framed as an effort to anchor high value jobs, talent and intellectual property in Canada.

From an entrepreneur’s perspective, this is the more interesting policy question: can Canada keep the value creation here as quantum companies mature, or will the biggest commercial wins migrate to larger markets? A round led by a UK firm, with US and UK operations in the mix, shows how global the capital stack already is.

What to watch next

Photonic has been explicit that this is a first close, not necessarily the final size of the round. If the company does bring in more capital in the near term, the next signals that matter for Canadian business owners will be less about qubit counts and more about concrete commercial milestones: paying enterprise customers, repeatable deployments, and partnerships that translate into real procurement pathways for Canadian suppliers and service firms.

For now, the clearest fact is that a Vancouver based company has secured a major tranche of funding with blue chip Canadian participation, positioning itself as an “anchor” quantum company in Canada and trying to move quantum from national strategy documents into enterprise buying decisions.